ESGnomics : The imperceptible importance of biodiversity

Marc-Antoine Collard, Chief Economist & Head of Research Rothschild & Co Asset Management.

Biodiversity loss is still relatively poorly acknowledged but is nonetheless a critical challenge as this has consequences for growth, prices and employment, as well as the performance of financial institutions. The adoption of a global biodiversity framework that adds up to no net loss of nature is paramount to secure our own survival and well-being alongside that of the planet.

Accelerated decline in biodiversity due to human activity

Biodiversity plays an important role through the services it provides to the socio-economic system. These services are grouped into three main types: (i) provisioning services, such as food, fuel and drinking water; (ii) regulating and maintenance services, such as pollination, climate stability, air quality and erosion control; and (iii) cultural services, such as tourism. Evaluating the monetary value of these service flows is complex, but a 2014 well-known paper estimates the global value of ecosystem services at USD 125 trillion/year, or approximately 1.5 times larger than global GDP at the time when the paper was written(1). For instance, the pollination services are worth USD 235-577bn of annual global food production while the coral reefs generate almost USD 40bn in ecotourism value(2).

Yet, the – negative – rate of global change in nature over the past 50 years is unprecedented in human history(3). In fact, humans have transformed the majority of the world’s ecosystems, destroying, degrading and fragmenting terrestrial, marine and other aquatic habitats, and undermining the services they provide.

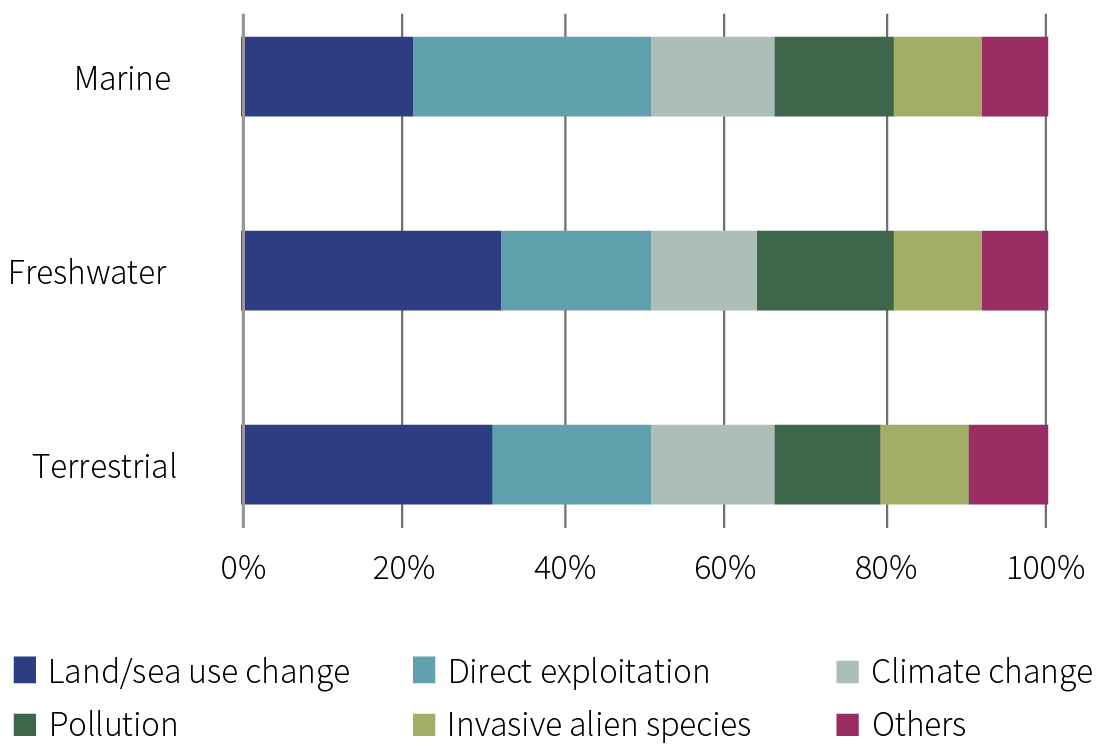

Globally, there are five main direct drivers explaining this trend: changes in land and sea use, direct exploitation of organisms, climate change, pollution, and invasion of alien species. To address this issue, governments from around the world will gather in December 2022 in Montreal, Canada, and try to agree on a new set of goals to guide global action through 2030 to halt and reverse nature loss. Indeed, the latter has far-reaching consequences.

World - Drivers of biodiversity loss

Source: IPBES (2019), Rothschild & Co Asset Management Europe, November 2022

Biodiversity loss creates socioeconomic risks…

All companies depend on ecosystem services, such as clean air, fresh water, fertile soils and a stable climate, to varying degrees. At the same time, all companies have impacts on the natural systems that provide those services. Despite their invaluable contribution to society, the majority of ecosystem services are not priced because they are public goods, leading to externalities. As a result, producers and consumers have insufficient economic incentives to conserve, sustainably use and restore biodiversity.

Correspondingly, the risks posed by biodiversity loss to human societies are significant and could also interact with the risks posed by climate change. For instance, damaged ecosystems might exacerbate climate change by releasing carbon instead of storing it. Deforestation or forest degradation is a major source of greenhouse gas emissions, while oceans are also significant stores of carbon dioxide (CO2) and their thermohaline circulation plays a crucial role in regulating the climate.

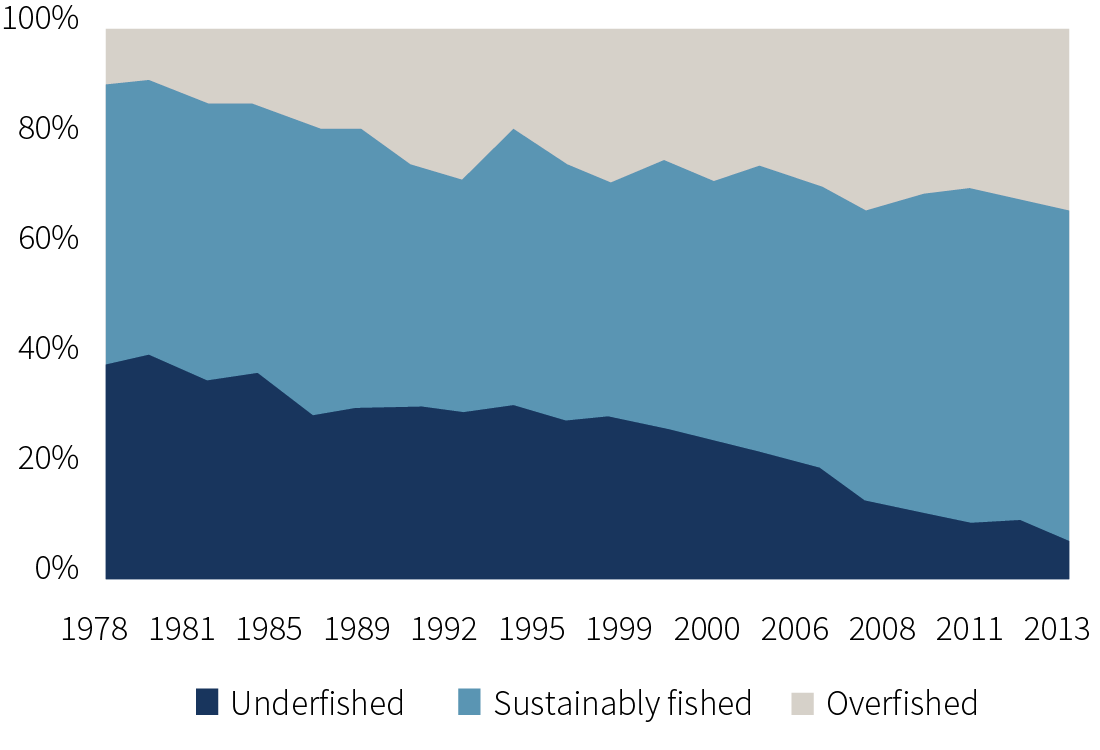

Unsustainable fishing remains a major threat to marine ecosystems and over 30% of fish stocks are fished at biologically unsustainable levels(4). Also, crop yields are declining, while human health is being affected at numerous levels by worsening water and air quality, and by more frequent and intense flooding and fires(5). These effects are set to grow, with many hard-to-measure indirect impacts potentially entering into play.

World - Marine fish stocks

Source: FAO (2018), Rothschild & Co Asset Management Europe, November 2022

What’s more, rampant development is putting animals and humans in closer contact increasing the risk of diseases like COVID-19 to spread. A recent United Nations Environment Programme report found that about 60% of human infections are estimated to have an animal origin(6). Thus, scientists are warning of an increased likelihood that future pandemics could emerge more often, spread more rapidly, kill more people, and affect the global economy with more devastating impact than ever before.

While biodiversity loss is often highly localised, it has the potential to generate cross-country impacts. For example, it could affect global value chains and international trade. At scale, it can also create geopolitical risks, notably through migration and conflict.

…and financial risks

Biodiversity loss could pose risks to the financial system through complex feedback loops and externalities, although estimating the financial system’s exposure is a tricky task for several reasons. One aspect of this complexity consists of the fact that, unlike in the case of climate change, where a common measurement unit (ton of CO2 equivalent) can be used to summarise effects, biodiversity can hardly be described using a single indicator. Furthermore, while there is a consensus that crossing critical ecological thresholds may lead to catastrophic and irreversible results, it is hard to predict exactly where these tipping points lie(7).

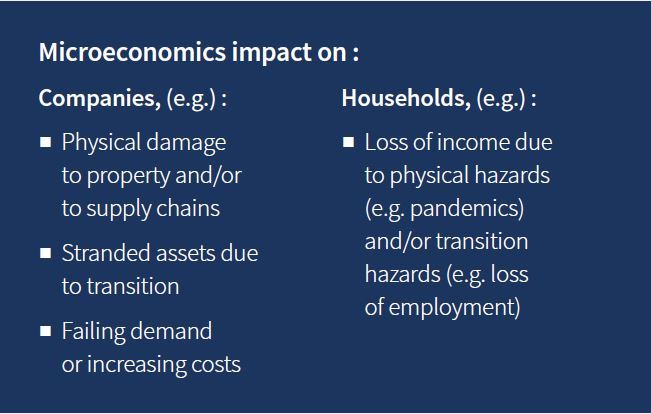

Still, just like climate-related financial risks, the financial risks linked to biodiversity can be organised into two categories: physical and transition risks. To approximate the former, researchers try to measure businesses dependencies on any of the three ecosystem services: the more a firm’s output depends on certain ecosystem services, the greater the likelihood that its production will be affected if the provision is disrupted. In that regard, a paper from Banque de France(8) has found that more than 40% of the value of the securities held at end-2019 by French financial institutions came from issuers that were highly or very highly dependent on at least one ecosystem service, which is consistent with the results obtained in a similar analysis of the Netherlands financial system.

Meanwhile, government measures, litigation and changing consumer preferences aimed at reducing the damage to biodiversity and ecosystems – caused by firms that create these impacts – can translate into transition risks if financial institutions are exposed to these businesses directly or indirectly.

Overall, the degradation of nature can result in potentially severe losses and disruption to economic activity. Between 1997 and 2011, the world lost an estimated USD 4-20 trillion per year in ecosystem services owing to land-cover change and USD 6-11 trillion per year from land degradation(9). Accordingly, action to halt and subsequently reverse biodiversity loss needs to be scaled up, especially as it is rather fundamental to achieving food security, poverty reduction and more inclusive and equitable development.

(1) Costanza R., de Groot R., Sutton P. et al., “Changes in the global value of ecosystem services”, Global Environmental Change, Vol. 26, ScienceDirect, 2014

(2) OECD, “Biodiversity: Finance and the economic and business case for action”, 2019

(3) IPBES, “Summary for policymakers of the global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services”, 2019

(4) FAO, “The State of World Fisheries and Aquaculture: Meeting the Sustainable Development Goal”, 2018

(5) Banque de France, “Biodiversity loss and financial stability: a new frontier for central banks and financial supervisors?”, 2021

(6) United Nations Environment Programme and International Livestock Research Institute, “Preventing the Next Pandemic: Zoonotic diseases and how to break the chain of transmission”, 2020

(7) Hillebrand H., Donohue I., Harpole W. S. et al., “Thresholds for ecological responses to global change do not emerge from empirical data”, Nature Ecology & Evolution, Vol. 4, No. 11, 2020

(8) Svartzman R. et al., “A ’Silent Spring’ for the Financial System? Exploring Biodiversity-Related Financial Risks in France”, Working Paper, No. 826, Banque de France, 2021

(9) OECD, op. cit.