Monthly Macro Insights | February 2023

" An earlier and faster-than-expected reopening of China, as well as the easing of Europe’s energy crisis, have improved the global growth outlook. Meanwhile, investors strongly believe that central banks are almost finished with their tightening campaign amid a fall in global inflation, and that policy rates will be lowered as soon as the second half of 2023. Still, uncertainty around this Goldilocks scenario remains elevated."

(Already very low) Recession concerns have disappeared…

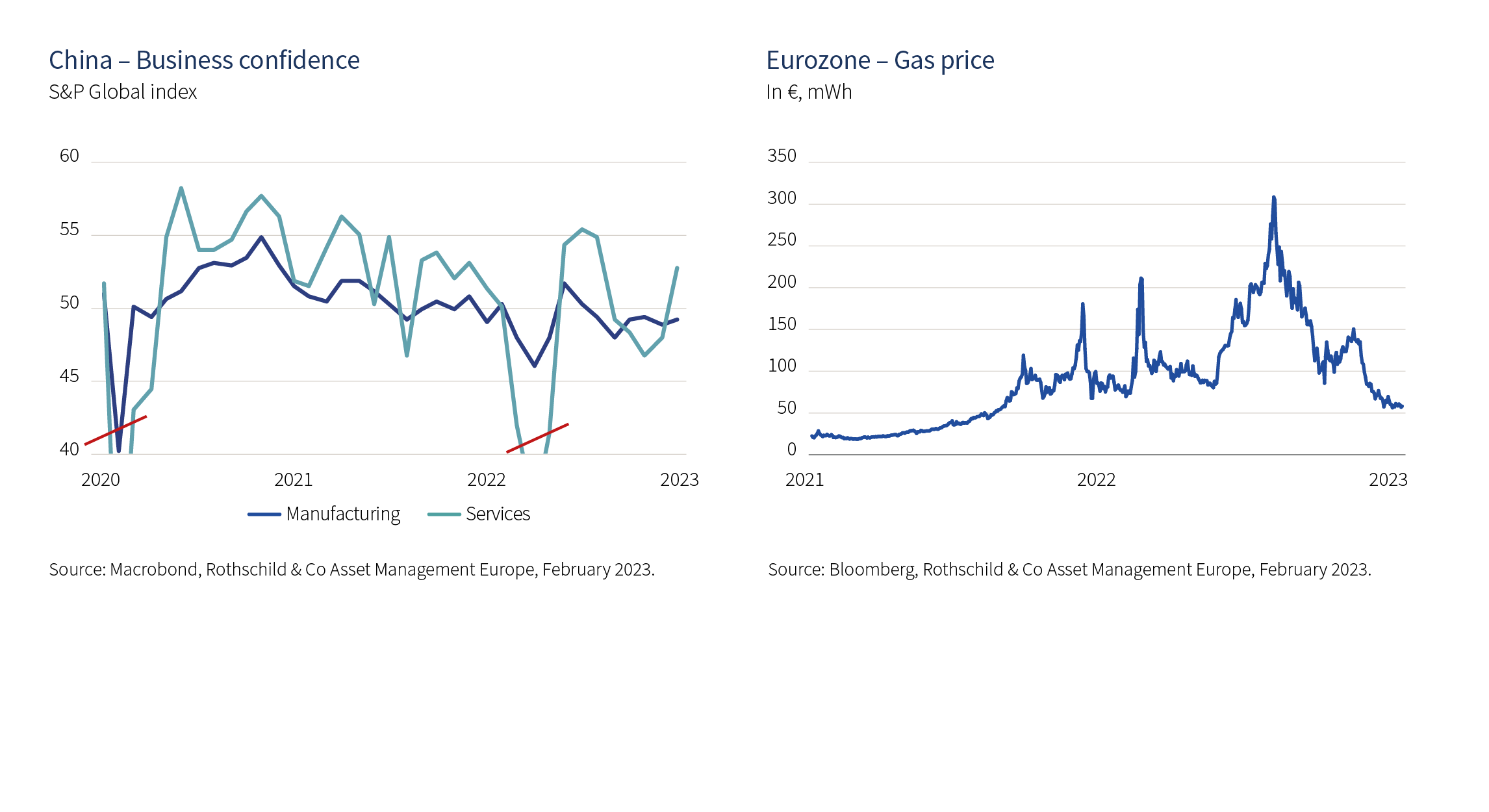

January business confidence data showed China’s service sector had a positive start to 2023, buoyed by hopes that the recent loosening of pandemic restrictions will feed through to further improvements in economic activity. Compared to its October 2022 projection, the January 2023 IMF projection for China’s growth forecast for this year increased almost one percentage point to 5.2 per cent. However, how strong and sustained the likely pick-up will be is an open question. The consensus belief is about a robust pick up, fuelled by pent up demand and financed by an excess of savings. Yet the latter is certainly not distributed evenly, as the relatively well-off captured the lion’s share and are unlikely to run down their savings meaningfully, their propensity to consume being both stable and not particularly high.

What’s more, uncertainty regarding the overall outlook remains elevated, with the implication that precautionary savings might very well stay high. The Chinese economy also still faces several headwinds, such as demographic and property market challenges. In Europe, natural gas price forecasts have been marked down significantly thanks to unusually mild weather and higher-than-expected gas storage levels, sharply reducing the risk of forced rationing. As supply chain disruptions eased and near-term energy market worries receded, businesses have become less pessimistic as the January S&P Global business confidence index in the Eurozone moved up to the neutral 50-threshold for the first time since June, adding to hopes that the upturn will gather steam in the coming months.

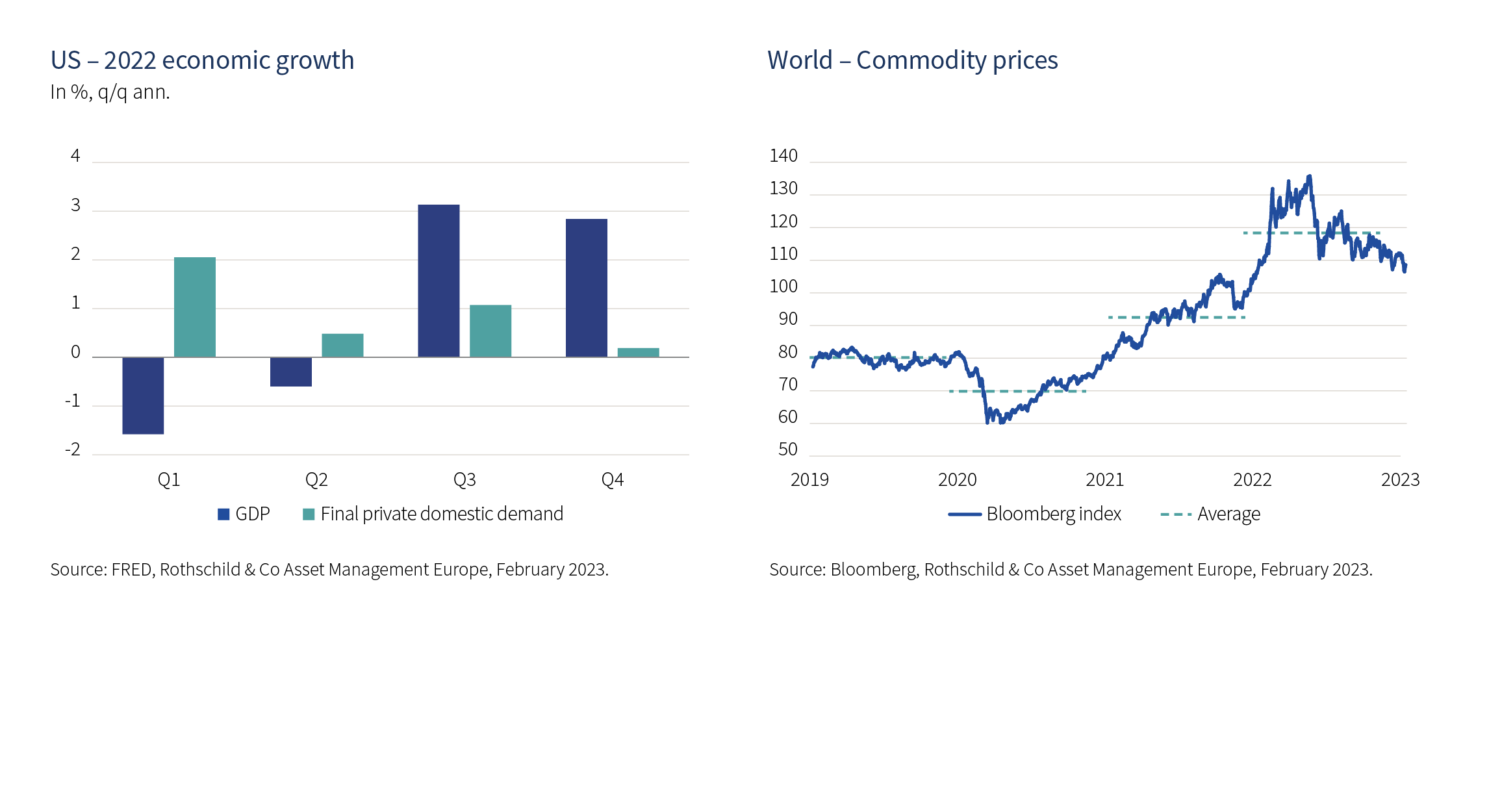

But as China’s reopening gathers steam and Europe’s recession fears have evaporated, US momentum is sliding more sharply than expected. While GDP expanded 0.7 per cent quarter-on-quarter – or 2.9 per cent annualised – in Q4 2022(1), the composition of growth raised concern. Although real consumption remained solid, households turned cautious at year-end as both November and December spending contracted. Business investment was weak, residential investment slumped once again, and underlying activity that strip out volatile components – such as inventories and trade – showed meagre growth. In fact, the inversion of the yield curve(2), the fall of the Conference Board leading indicator and the very weak ISM manufacturing index(3) – lowest level since the 2008 GFC barring the short-lived pandemic drop – are all signalling a significant risk of a recession. For now, investors have decided to ignore this soft data and remain optimistic that the US will achieve a soft landing, as real disposable income rises on the back of fading fiscal tightening and still relatively high wage growth, the drag on growth from tighter financial conditions fades, and disinflation continues.

… but the inflation debate is still unsettled

Global headline inflation appears to have peaked in Q3 2022, but underlying (core) inflation has not and remains well above pre-pandemic levels. Looking ahead, market participants expect that the normalisation of commodity prices will lead to a large decline in the headline inflation, while the healing of supply chains will bring down core goods inflation. In the US, housing inflation, which is still very elevated in the official CPI and PCE measures, is set to decline substantially in 2023, given that timelier measures of rents have already started to stagnate or even fall. Yet, the volatility around this scenario remains elevated. First, whether China’s reopening will be inflationary or deflationary is debatable. On the one hand, surging commodity demand on the back of China reopening and better global growth, against a backdrop of low inventories and limited excess production capacity, could be enough to upset the commodity-led disinflation scenario. That said, the reopening could accelerate the resolve lingering supply chain issues, hastening disinflation in the goods sector.

Then, the labour market rebalancing that’s required to return wage growth to a pace more consistent with central banks’ target is unclear. History shows the unemployment rate will have to increase substantially – with recessionary consequences – to cool the overheated labour market and rein in wage inflation. In contrast, investors anticipate it can largely be achieved through declines in job openings, since the actual tightness is believed to not be induced by too many people being employed, but because the number of job vacancies is too high.

From unconditional to conditional tightening

As expected, the ECB and the Bank of England (BoE) hiked their key interest rates by 50bps in early February. The BoE appeared to signal that the tightening cycle may be approaching its end, endorsing the market view that the Bank rate will peak around 4.25 per cent in coming months. Still, it warned that if there were to be evidence of more persistent inflation pressures, then further tightening in monetary policy would be required. For its part, the ECB remained hawkish(4), the Governing Council intending to hike another 50bps at the March meeting and then continue the tightening, while insisting it will stay the course in raising interest rates significantly at a steady pace and in keeping them at levels that are sufficiently restrictive to ensure a timely return of inflation target.

Eurozone inflation slowed more than expected in January, according to the flash estimate, falling to 8.5 per cent from 8.9 per cent in December. However, underlying price pressures remain very elevated as core inflation stayed at an all-time high of 5.2 per cent(5). Meanwhile, the Fed slowed the pace of rate hikes to 25bps, raising the fed funds rate to 4.75 per cent as softer-than-expected inflation readings seem to have justified the downshift. In a hawkish signal, the policy statement continued to emphasise that ongoing rate increases (i.e. at least two) will be appropriate to bring down inflation, thus suggesting that the 5.25 per cent terminal rate was still relevant. However, Chair Powell conceded that the US economy was in the early stages of a disinflation and did not push back at all on the recent easing of financial conditions, offering investors – unintended? – dovish(6) signals.

Yet, the tightness of the labour market is undoubtedly a cause for concern. The December JOLTS(7) showed that job openings rose to their highest level in five months, quits rate was nearly steady at a historically elevated level, 517,000 jobs were created in January and the unemployment rate fell to an almost 60-year low of 3.4 per cent(8). The divergence between how the Fed thinks the policy rate will evolve – higher for longer – and market pricing is significant. Investors becoming so optimistic about inflation that they expect the Fed to cut rates in H2. Overall, recent central banks’ meetings indeed suggest monetary policies will become more restrictive in the next few months, but at a significantly lower pace compared to the 2022 tightening campaign. However, this hardly prefigures rate cuts anytime soon as the inflation fight is likely much more complex than what is priced in.

(1) Source: National Bureau of Statistics of China, February 2023.

(2) Graphical representation of bond yields according to their different maturities. In a stable economic environment, without inflationary pressure and excessive debt, interest rates increase with the maturity date of the bond.

(3) Survey reflecting the perception of decision makers in the US manufacturing sector.

(4) Positioning in favor of a less accommodating monetary policy to fight inflation.

(5) Source: Eurostat, February 2023.

(6) Positioning in favour of a less restrictive monetary policy.

(7) Job Openings and Labor Turnover Survey.

(8) Source: U.S. Bureau of Labor Statistics, February 2023.

Press Contacts:

Gunther De Backer

Olivier Duquaine