Monthly Macro Insights | June 2022

Marc-Antoine Collard, Chief Economist & Head of Research

" Most business confidence surveys continue to display impressive resilience in the face of significant headwinds. Conversely, consumer morale has reached dire levels amid surging inflation. Investors still hope the Goldilocks scenario of moderating inflation and supply-led growth will emerge in H2 2022, allowing central banks to slow down global monetary tightening.."

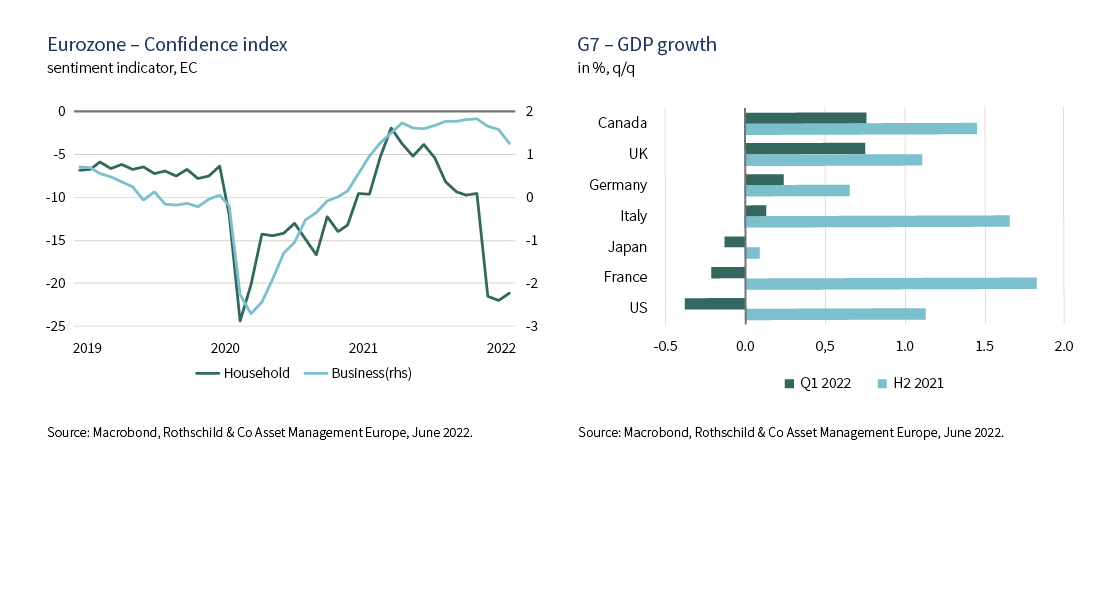

Disappointing H1 2022 results

Global GDP hit a soft patch in Q1 2022 – especially in France, Japan and the US – and is decelerating sharply this quarter, held back by an expected slump in China where the Covid drag is proving to be deeper and more persistent. The latest PMI data indicated that China’s service and manufacturing sectors experienced further decline in May for the third successive month amid travel bans and forced quarantine. However, the rate of contraction eased noticeably as the authorities slowly started to lift some restrictions thanks to lower new contamination figures. Furthermore, credit growth is expected to strengthen with a significant acceleration in government bond issuance as fiscal supports pick up steam. Looking ahead, the zero-Covid policy nonetheless implies high uncertainty as economic activity continues to face the risk of renewed lockdowns. In fact, how quickly China recovers from its Omicron-induced Q2 GDP contraction and how that slowdown spills over into the rest of the world constitutes a set of important questions for the global outlook.

Outside of China, the latest business surveys revealed some loss of momentum, but at the same time depicted a remarkable resilience despite significant headwinds – the Russian war, surging commodity prices, tightening financial conditions, and the spillover from China’s downturn. Meanwhile, the momentum of inflation has continued to build at a surprising pace in the US and Europe, necessitating a more aggressive tightening of policy by central banks. The purchasing power squeeze on households continues, although strong employment and income gains as well as accumulated savings represent an important cushion.

Inflation dynamics remain key to the outlook

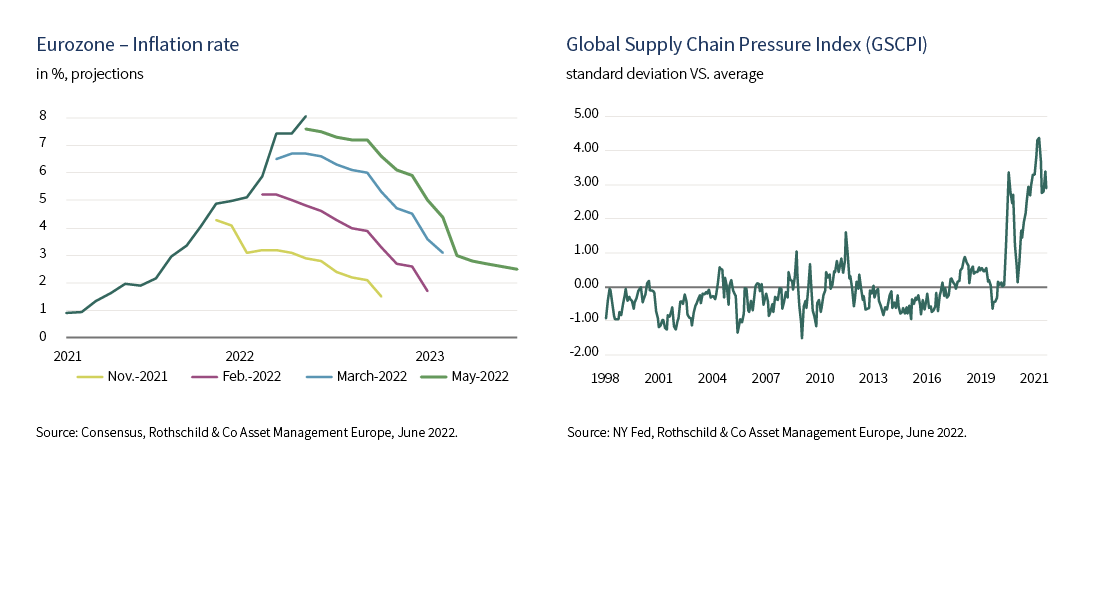

Overall, near-term recession risks remain low, and investors hope growth will rebound in H2 2022 as price pressures recede. In the US, CPI inflation moved down from the 40-year high of 8.5% in March to 8.3%(1) in April, with further declines expected in the coming months. The descent would be the result of the Fed action that, while being delayed, was just in time to keep inflation expectations anchored, but also due to strong base effects, rotation of demand from goods to services and an improvement in supply chains disruptions. Despite near consensus that US inflation has peaked, the jury is still out as to how quickly it will decelerate, which will shape Fed policy. In that regard, the recent trends in bottlenecks call for caution.

While the New York Fed’s supply chain pressure indicator showed the invasion of Ukraine has not damaged supply chains as much as feared, the index nonetheless remains 3 standard deviations above normal and near levels that arose during the pandemic. In the labour market, data are mixed. Wage inflation seems to have stabilised rather than continuing to climb and the participation rate has improved. However, the latter is up a mere 0.4 percentage point over the past six months and is still a full point below the pre-Covid peak of 63.4%(1) which was already considered abnormally low by historical standards.

In addition, more than two years into the pandemic, unfilled job vacancies have increased sharply even though employment has yet to fully recover. Several factors have contributed to this phenomenon, namely the mismatch arising from discrepancies between the types of vacant positions and the skills of job seekers. Health-related concerns, which may be a significant driver of the withdrawal of older workers from the labour force, and changing preferences among workers have also been identified as potential factors.

Will Powell have a Volcker moment?

Overall, the soft-landing scenario involves restraining demand – which monetary policy can achieve through the interest rates tool – while awaiting a recovery in supply. Were the later not materialising fast enough to avoid a prolonged inflation environment – thus risking to de-anchor inflation expectations – central bankers would then face a difficult monetary policy trade-off.

Although global inflation in 2022 remains less broad-based than it was in the 1970s, the current juncture resembles that period in some respects: supply shocks in the near-term, preceded by a protracted period of highly accommodative monetary policy in major economies, together with marked fiscal expansion. To fight the wage-price spiral, monetary policy was tightened in the early 1980s which ultimately reduced inflation in advanced economies to a median of 3% in 1986 from its peak of 15% in 1974(2). This established central bank credibility, but it was earned at a high cost. In the US, Paul Volcker was nominated as Fed Chair in 1979 and, for anyone unfamiliar with his legacy, he is widely credited with having ended the high levels of inflation thanks to policies that delivered two consecutive recessions in 1980 and 1981.

In the past few months, most Fed members have acknowledged that tackling inflation would require the Fed funds rate to reach, by year end, the neutral level considered neither supportive nor restrictive for growth, estimated at around 2.5%(3). Given the recent tightening in financial conditions and weaker growth expectations, some investors foresee the Fed softening its tone and pausing rate rises in September in order to assess the impact of the tightening campaign. Conversely, a more restrictive stance of policy might become appropriate were supply fails to normalise and inflation stubbornly stays elevated, although it remains to be seen if Fed Chair Jerome Powell will embark on the same path as Volcker did some 40 years ago.

(1) Source: U.S Bureau of Labor Statistics, May 2022.

(2) Source: World Bank, May 2022.

(3) Source: FOMC, May 2022

Press Contacts :

Gunther De Backer

Olivier Duquaine