Monthly Macro Insights | September 2022

Marc-Antoine Collard, Chief Economist & Head of Research

" Investors had hoped bad macroeconomic news was good news as central banks would pause their tightening cycle, thus allowing the global economy to avert a recession despite being buffeted by multiple adverse shocks. Yet, central bankers delivered a stern and unified message at Jackson Hole on the need to curb inflation, placing strong emphasis that restoring price stability will likely require maintaining a restrictive monetary policy stance for some time."

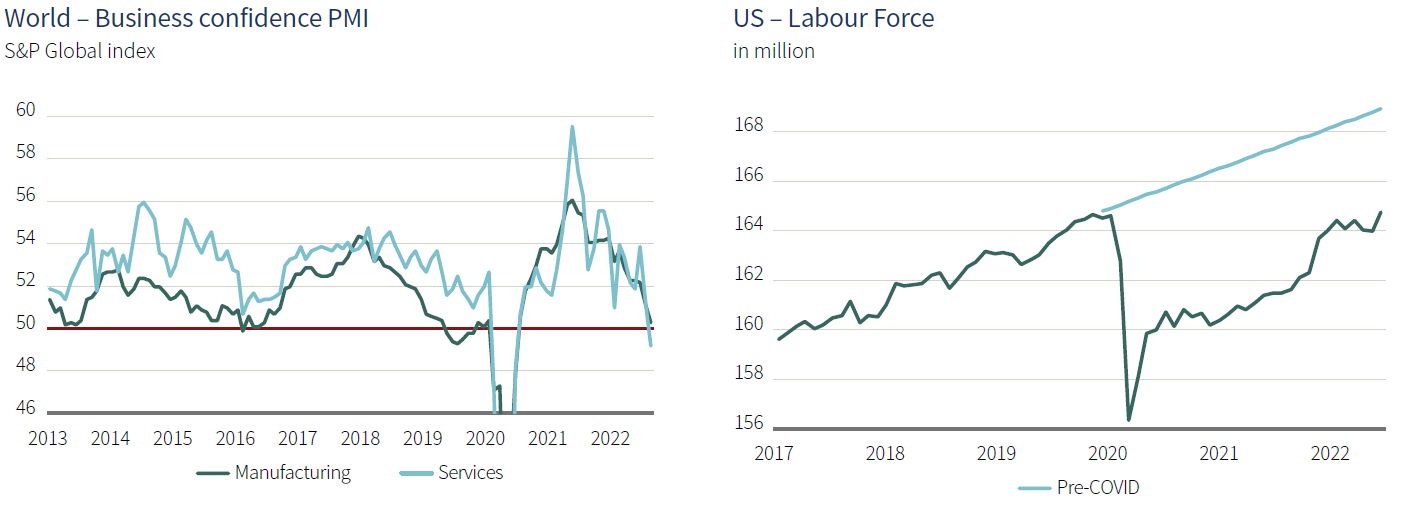

Business confidence keeps worsening...

In the manufacturing sector, the S&P Global business confidence index fell to 50.3[1] in August, the lowest level in more than two years. The output sub-component fell below 501, which would be compatible with an outright contraction in global factory production in early H2 2022. What’s more, the outlook seems increasingly weak as the orders-to-inventory ratio fell to its lowest level outside recession in the last quarter century, suggesting excess capacity building at factories. Business confidence in services plummeted in August to 49.21, signalling a contraction for the first time since June 2020.

Overall, the composite index fell to 49.31, a level rarely seen outside of global recession, and a decline in the new orders sub-component is particularly concerning as it suggests that multi-decade high inflation and the corresponding synchronized monetary tightening are weighing considerably on global demand. On the bright side, supply chain pressures seem to be abating as suggested in the shortening in delivery times sub-component, declining global shipping costs, and a drop in US non-fuel import prices. In fact, a substantial moderation in global goods price inflation outside Europe is likely.

Source: Macrobond, Rothschild & Co Asset Management Europe, Septembre 2022

... while regional divergence is widening

Although the US GDP fell in Q1 and Q2 2022 which confirmed a clear loss of momentum, the August jobs report kept alive the hope that a soft-landing remains possible as the labour market added 315,000 jobs[1]. The unemployment rate surprised to the upside, increasing to 3.7% from 3.5%, but the rise was explained by an encouraging move up in the participation rate from 62.1% to 62.4%2. In fact, a variety of indicators suggest the imbalance between labour supply and demand eased in August. However, a single month’s improvement falls far short of what the Fed will need to see before it gains confidence that the tightness in the labour market is cooling.

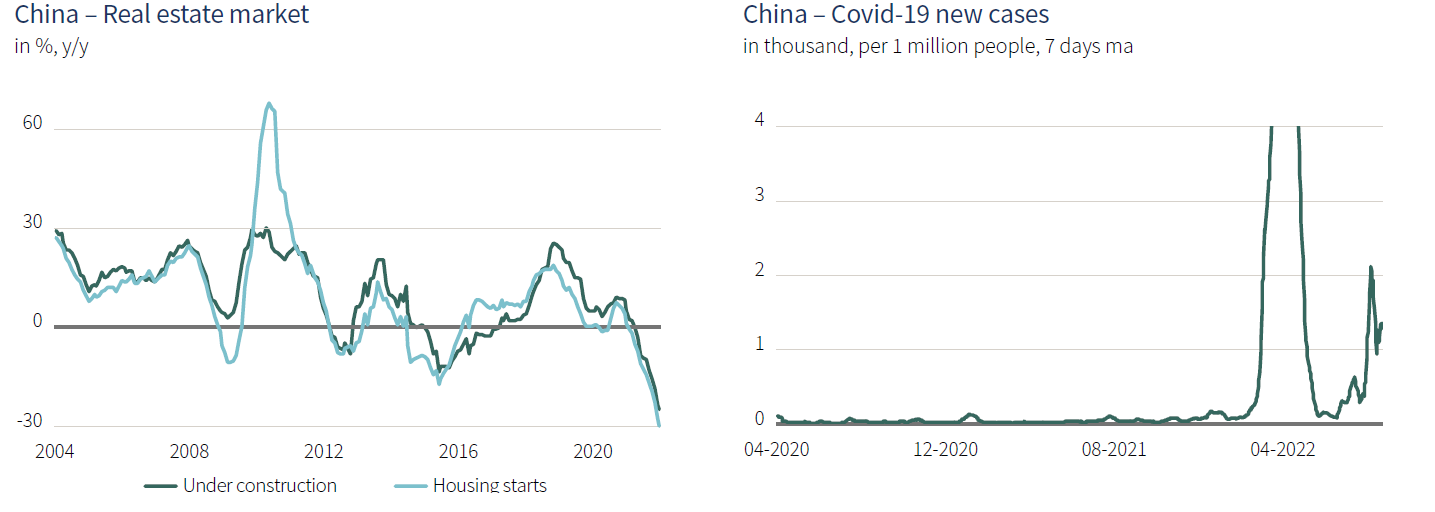

In China, the signal emanating from business surveys is that momentum from the post-lockdown rebound is falling back sooner and by more than anticipated as the economy is facing headwinds on multiple fronts: ongoing threats of virus outbreaks and lockdowns amid Zero-Covid policy, an historic drought that has cut electricity generation at hydropower plants, and turmoil in the property market. Policymakers appear to recognize these risks and have responded with rate cuts and new round of stimulus measures to support central government infrastructure projects, local government bond issuance, and energy sector investments to ensure stable power supply. While these announcements remove the risk that government policy magnifies a growth slowdown, they might not be enough to keep growth from moderating substantially.

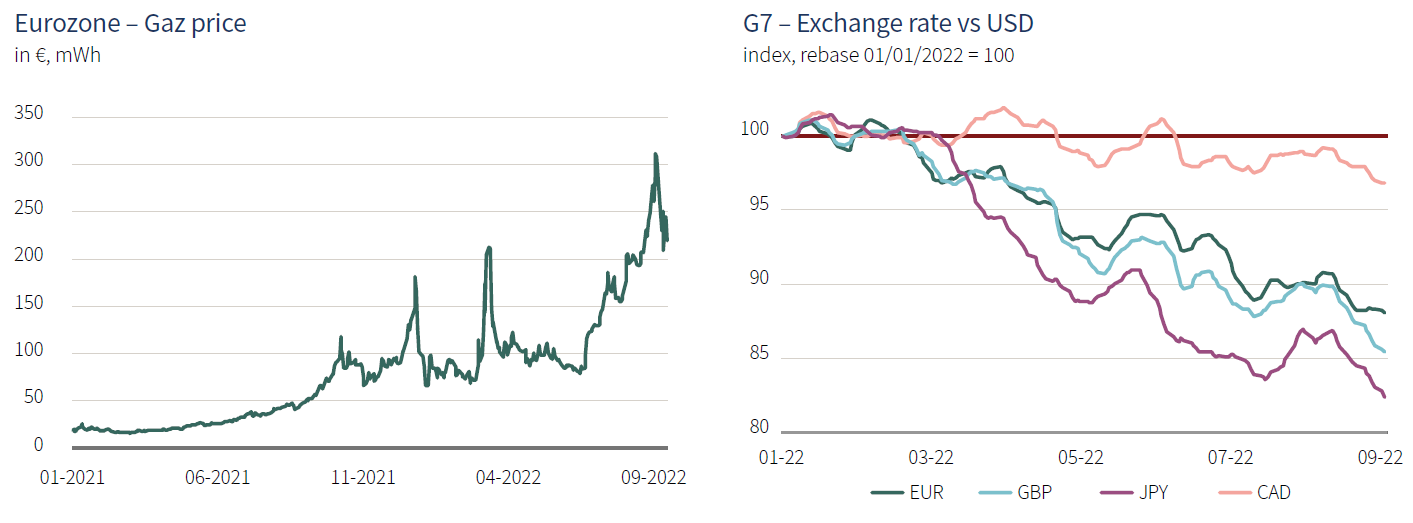

Meanwhile, Russian gas deliveries through Nord Stream have been cut off for maintenance in late August and state-controlled supplier Gazprom announced that the pipeline would remain closed indefinitely, a move that marks a dramatic escalation in Europe’s energy crisis. Correspondingly, business confidence dropped again in August as the S&P Global index (48.9)[1] fell deeper below the 50-threshold3 in the Eurozone. The European Union has been seeking to prepare for the risk of a Russian gas cut off by replenishing reserves, securing alternative supplies such as liquefied natural gas from the US and reining in demand. Some member countries also want to break the link between wholesale gas and electricity prices, arguing that electricity producers using renewable or nuclear power should sell production at a much lower price.

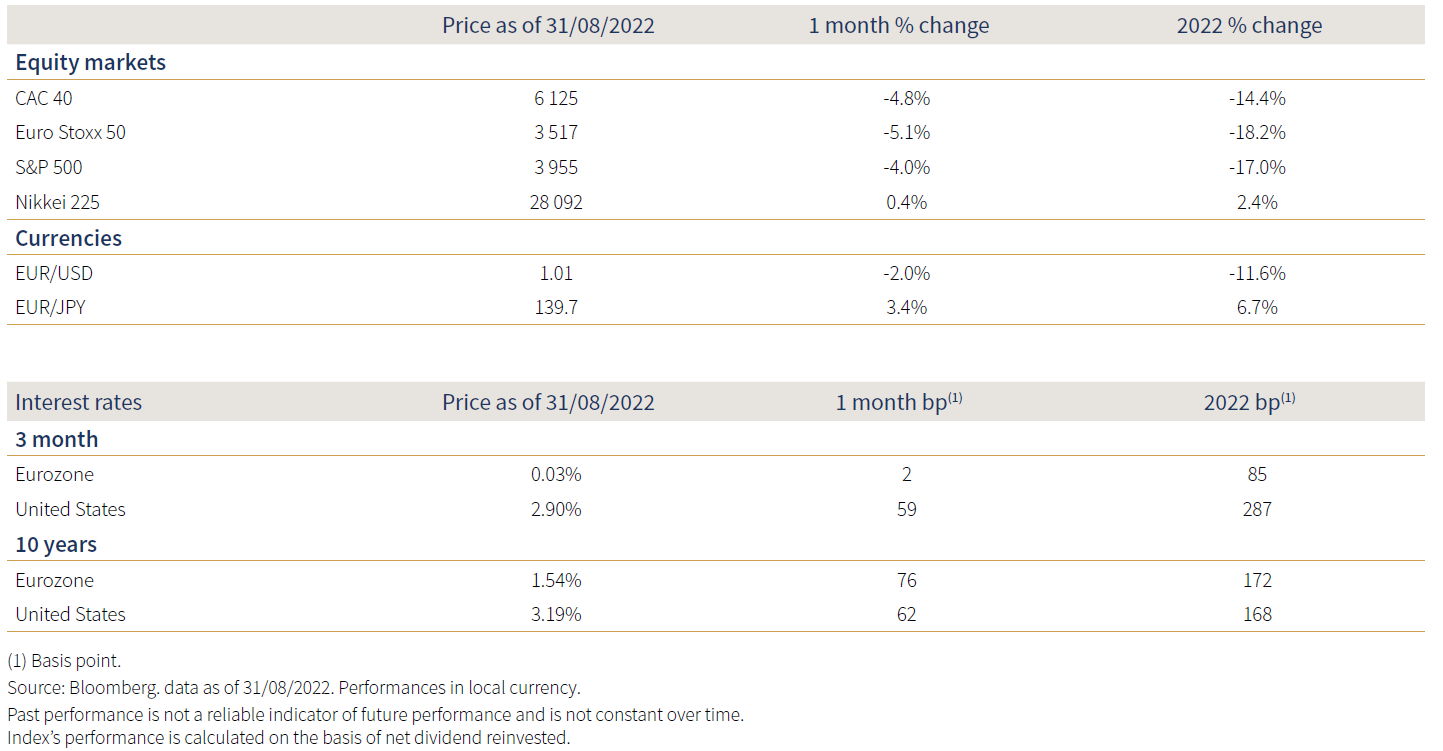

Investors still don't foresee a global recession

Historically, large US shocks have had powerful negative global reverberations, while weakness concentrated in Europe or Asia had limited spill overs outside their respective regions. In that regard, recent developments have reassured investors, shifting the focus from global recession risks to a potential phase of divergent performance more akin to the Eurozone sovereign crisis (2011-12).

Source: Macrobond, Rothschild & Co Asset Management Europe, Septembre 2022

Yet, the uncertainty regarding the ramifications of the energy shock and monetary policies’ stance on the economic growth remains very elevated. For instance, the Bank of England has warned that the UK will fall into recession, starting in Q4 2022 and lasting five quarters as real disposable income falls sharply and consumption begins to contract amid higher inflation and interest rates. Admittedly, investors expect the economy to hit a soft patch, but remain much more sanguine regarding the economic outlook.

Meanwhile, the ECB finds itself between a rock and a hard place as the energy crisis increases the prospect of blackouts and economic turmoil across the continent, which would favour a prudent monetary policy stance. However, according to the flash release, Eurozone inflation reached a record 9.1% in August, while the core measure was up 0.3 percentage point to 4.3%[1]. Looking ahead, a more intense passthrough of gas and electricity prices looks likely and as a result, inflation might surpass 10% before year end.

In the US, the Fed re-emphasized its commitment to tightening policy in order to bring supply and demand into better balance in order to tame inflation pressures. What’s more, officials continued to push back on the notion that rate cuts could occur next year, instead highlighting that the Fed’s inflation fight is likely to be a long process that requires sustaining a restrictive stance for some time as a failure to restore price stability would mean far greater pain. In that context, the dollar keeps rising, reaching a 24-yr and 37-yr against the yen and the sterling pound, respectively, while the euro fell below parity for the first time since 2002. Although the anti-inflationary impact of the surging dollar might be comforting in the US, its strength might spell rapid darkening prospects for the rest of the world.

Completed writting on 8 September 2022

Source: Macrobond, Rothschild & Co Asset Management Europe, Septembre 2022

Performance of the indices and intrest rate levels

(1) Source: S&P Global, Août 2022

(2) Source: US BLS, Août 2022

(3) Source: S&P Global, Août 2022

(4) Source: Eurostat, Août 2022

Press Contacts :

Gunther De Backer

Olivier Duquaine