Quarterly newsletter R-co Valor & R-co Valor Balanced | Q1 2023

Yoann Ignatiew, Fund Manager, Charles-Edouard Bilbault, Co-Fund Manager & Emmanuel Petit, Head of Fixed Income Rothschild & Co Asset Management.

International equity markets ended the quarter in positive territory. The MSCI World gained 7.3% in the first three months of the year, driven mainly by hopes of a coming shift in central banks’ monetary policies. In the US, the S&P 500 and Nasdaq gained, respectively, 7% and 16.8%. Despite a mixed performance on the month, Europe ended up by +13.7% (based the EuroStoxx 50), while China fared less well, gaining 3.1% (the Hang Seng index)(1).

The Silicon Valley Bank and Crédit Suisse episodes combining a crisis of confidence and bank runs tested the solidity of the US, and then European, banking systems. Joint actions by governments and central banks, based on their experience acquired in 2008, appear to have contained the damage. Investors cheered these actions and are now pricing in an easing in monetary policies.

In the United States, inflation continued to recede, but at a slower-than-expected pace in its core component (i.e., ex food and energy). The Fed stayed the course, raising its key rates by 0.25% to a range of 4.75% to 5%. In Europe, core inflation rose again, with the latest figure of +5.7% year-on-year(2). Core inflation now appears to be shifting towards services. As expected, the ECB raised its rates by 0.50%, to a range between 3% and 3.75%.

Things are quite different in China. Despite the end of the “zero-Covid” policy in late 2022, the rally in the indices fell short of expectations in the first part of 2023. Geopolitical tensions, combined with a lack of releases confirming a solid recovery, were one reason for apathy on the equity markets. Even so, China’s reopening, its low interest rates and its pro-growth measures are likely to produce a significant economic recovery in the coming months. Redeployment of much of individuals’ accumulated savings should offer significant support to a recovery that appears to be on the right track.

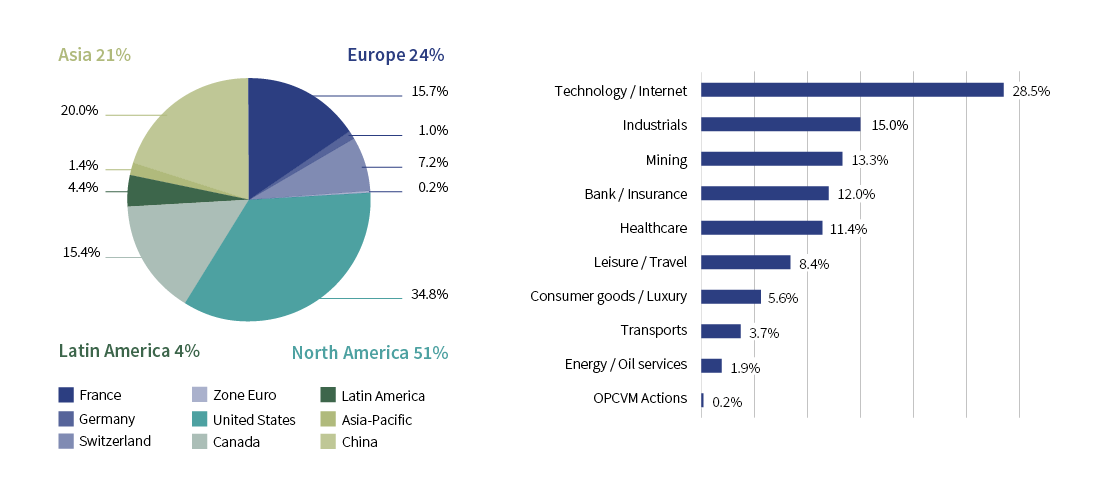

R-co Valor’s equity exposure was 77% as at the end of March, a low since January 2020. We stuck to our profit-taking strategy, as the equity markets got off to a robust start on the year even as global macroeconomic conditions worsened.

The rest of the allocation, 23%, is currently invested in the money market or similar, via money-market funds, as well as French government bonds dated less than one year(3). Few purchases were made during the first quarter, in line with our strategy of steering the portfolio towards a more defensive profile. We sold off our holding in the pharma group AstraZeneca after a solid 2022 (+29%(4)), as well our residual holding in the Royal Caribbean cruise line. Meanwhile, we sold into rallies by Manulife, Richemont, ABB and Hello Group, locking in profits and selling down our holdings in those stocks.

The fund is up 6.95% on the year to date(3). Financials took a hit from the failure of Silicon Valley Bank and made less of a contribution to performance. SVB accounted for 1% of the fund at the start of March and is now valued at 0. Tech stocks were the top contributor, driven mainly by the steep drop in the 10-year US bond yield and investors’ retreat into US big tech(5). Some of our healthcare stocks are also among the top year-to-date contributors. These include Seagen, which added 1% to fund returns after the announcement of a takeover bid by Pfizer(3).

The gradual worsening in macroeconomic releases, particularly the toughening of credit conditions, is making us rather cautious. This is why we have repositioned the portfolio towards a more defensive profile. We nonetheless still see opportunities in an environment in which the Fed is likely to halt its tightening stance in mid-year.

R-co Valor: Portfolio’s geographical and thematic breakdow

Portfolio Allocation

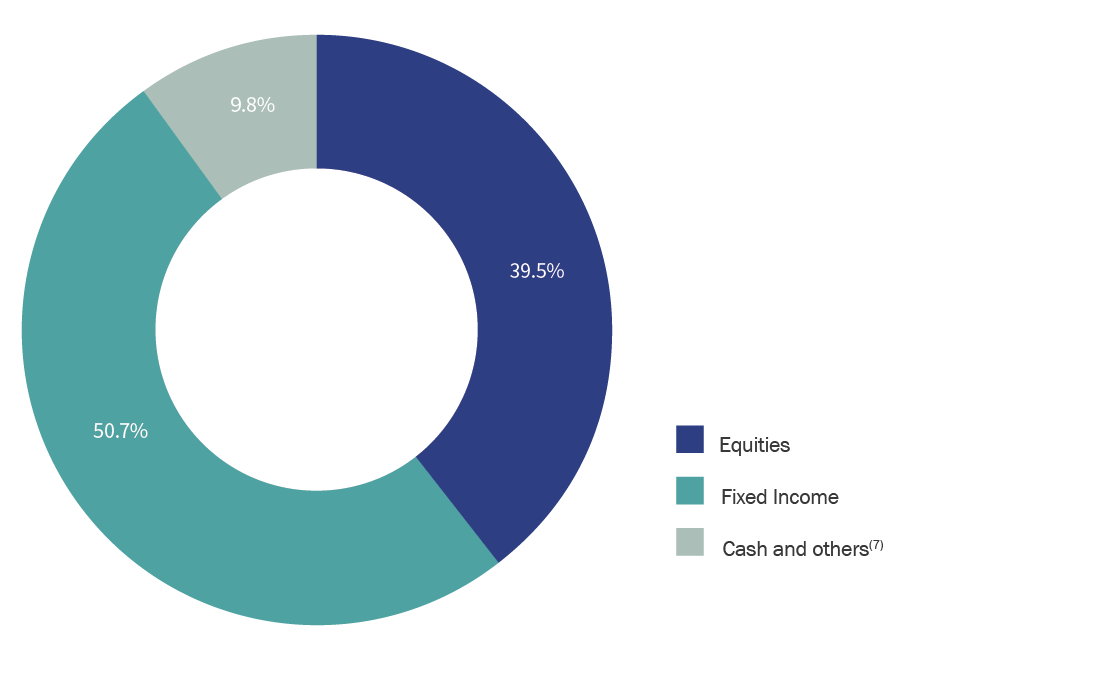

As at the end of March, R-co Valor Balanced’s equity exposure was 39.5%. Its bond exposure was 50.7%, with the rest in money-market and cash(6).

R-co Valor Balanced: Breakdown by asset classes

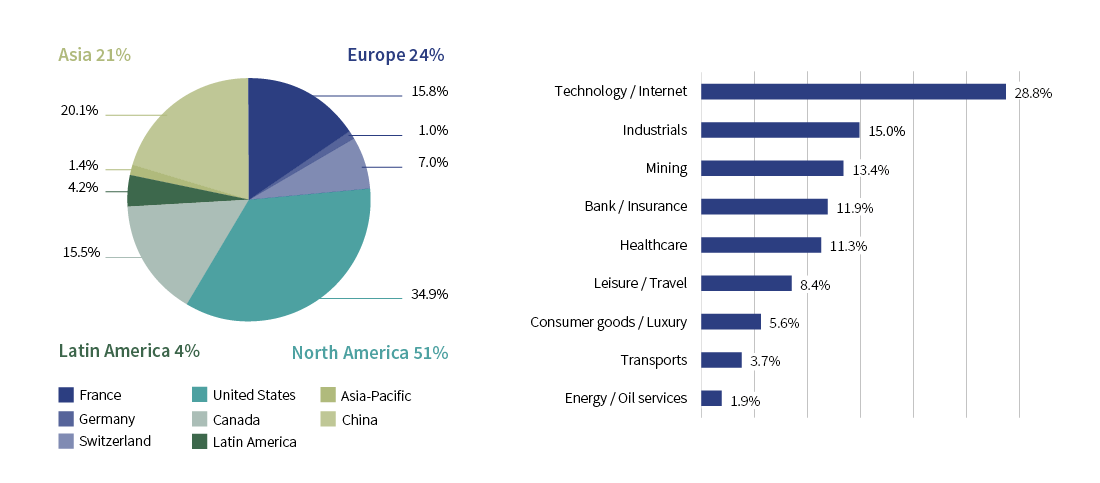

Equity allocation

R-co Valor Balanced equity allocation replicates that of R-co Valor. Both funds have the same exposures and are subject to the same modifications.

R-co Valor Balanced: Geographical and thematic breakdown of the Equity pocket

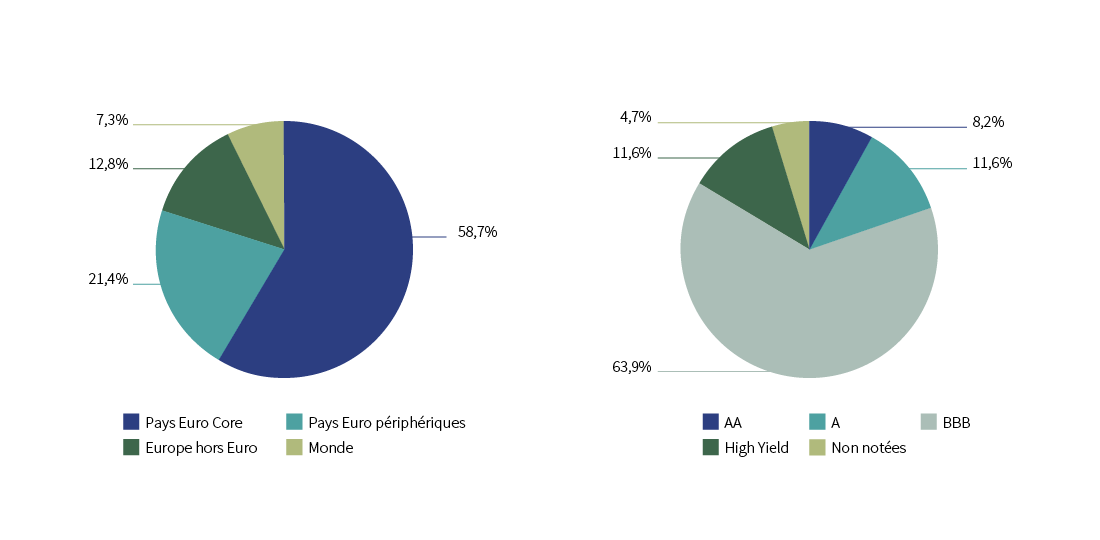

Fixed income allocation

After rising steeply in 2022, bond yields pulled back early in the year on both sides of the Atlantic. The 10-year US and German yields fell, respectively, by 41 basis points (bps) to 3.5% and by 27 bps to 2.3%(8). Receding fears of a hard landing also widened the Italian spread(9), with the 10-year yield down by 60 bps, to 4.1%. This surge in optimism, paired with investors’ expectations of looser monetary policy drove the euro bond asset class in the first quarter. Investment grade(10), for example, gained 1.7% and high yield(11), 2.8%(8).

The fund gained 4.55% on the quarter. By asset class, equities contributed about 75% of total performance, thanks mainly to the fund’s healthcare and tech exposure. The bond allocation also provided support in an environment of falling bond yields, accounting for 25% of performance on the period. Financials made a negative contribution, in both equities and bonds(12).

Within the fund’s bond allocation, the still-attractive yields in investment grade provided us with some opportunities, mainly on the primary market, with intermediate maturities and limited credit risk. We also took advantage of secondary-market opportunities, particularly in financials, during the second half of the quarter, before shifting towards non-financials. We lowered our high-yield and non-listed exposure marginally during the quarter, to 16% of the bond allocation. Market conditions allowed us to significantly raise the portfolio’s yield to 6.7% by the end of March, with a sensitivity of 3.4(12).

R-co Valor Balanced : Geographic and thematic breakdown of the bond portfolio

Find the pdf of the article here:

Rothschild & Co Asset Management - R-co Valor & R-co Valor Balanced

PDF 802 KB

(1) Inflation without food or energy.

(2) Source: Bloomberg, 30 December 2022.

(3) Purchasing Managers Index, an indicator that reflects their confidence in a particular economic sector.

(4) U.S. Bureau of Labor Statistics, January 2023

(5) The top US technology stocks.

(6) Source: Rothschild & Co Asset Management, 31/03/2023

(7) Cash and others : Money market funds, OATs under 1 year and cash.

(8) Source: Bloomberg, 31 March 2023.

(9) The spread is the gap in yield between a bond and bond of equivalent maturity regarded as “risk-free”.

(10) Debt securities that are issued by companies or governments and which are rated by Standard & Poor’s between AAA and BBB-.

(11) High Yield bonds are issued by companies or governments having high credit risk. They are rated lower than BBB- by Standard & Poor’s.

(12) Source: Rothschild & Co Asset Management, 31 March 2023.

Press Contacts:

Gunther De Backer

Olivier Duquaine